Wednesday, January 29th, 2014 and is filed under Oil and Gas Current Events

Strong growth in U.S. crude oil production, primarily attributable to growing volumes of light crude oil produced from onshore tight oil formations, has reshaped global oil markets in recent years. EIA expects this growth trend to continue for the next two years, as forecast in this month’s Short-Term Energy Outlook (STEO).

Strong growth in U.S. crude oil production, primarily attributable to growing volumes of light crude oil produced from onshore tight oil formations, has reshaped global oil markets in recent years. EIA expects this growth trend to continue for the next two years, as forecast in this month’s Short-Term Energy Outlook (STEO).

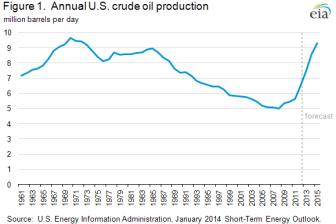

EIA estimates that U.S. crude oil production averaged 7.5 million barrels per day (bbl/d) in 2013, the highest annual average rate of production since 1989, and a 1.0-million-bbl/d increase from 2012 (Figure 1). In the January STEO, which extends the forecast period through 2015, EIA expects continued strong production growth. EIA projects crude oil production to average 8.5 million bbl/d in 2014 and 9.3 million bbl/d in 2015, which would be the highest annual rate of crude oil production since 1972. The record highest annual average crude oil production was 9.6 million bbl/d in 1970.

Production from tight oil formations in Texas, North Dakota, and a handful of other states has driven total crude oil production growth for the past four years. Development activity in these key onshore basins and increasing productivity as companies learn how to apply hydraulic fracturing techniques more effectively and efficiently are central to STEO’s forecast. In particular, EIA expects most growth through 2015 to result from drilling in the Bakken formation in North Dakota and Montana, the Eagle Ford formation in Texas, and the Permian Basin in Texas and New Mexico. Bakken production is expected to rise from the estimated December 2013 level of 1.0 million bbl/d to 1.3 million bbl/d in December 2015. Eagle Ford production is projected to increase from an estimated December 2013 level of 1.2 million bbl/d to 1.5 million bbl/d in December 2015. The Eagle Ford accounts for more than half of the onshore domestic liquids production growth because of a comparatively large amount of liquids coming from both oil and gas wells compared with the other key production basins.

The Permian Basin in West Texas, which includes thick, overlapping formations such as the Spraberry, Bonespring, and Wolfcamp, is a third key growth area. EIA estimates that crude oil production from the Permian Basin reached 1.5 million bbl/d in December 2013 and is projected to increase to 1.8 million bbl/d in December 2015.

Read more at EurasiaReview.com

© Copyright 2024 Aresco, LP. All rights reserved. | Privacy Policy | Site by A3K Marketing. Admin Log in