Wednesday, August 18th, 2021 and is filed under New Mexico Oil and Gas Investing, Oil and Gas Current Events, Texas Oil and Gas Investing

The revolution in North American energy continues to help our economy and provide compelling investment opportunities across the energy value chain.

In 2020, the United States produced 15% of the world’s crude oil production while Canada produced 5%, making North America the leading crude oil production area in the world. At the same time, the United States is now producing enough natural gas to meet the needs of the entire country independent of the need to import any natural gas. North American energy production now dominates the world, making it the go-to area for crude oil and natural gas investments.

North American energy production dominance results in improving business fundamentals for companies spanning the energy value chain — from the exploration and productions companies producing these valuable resources to the pipeline and related infrastructure companies that transport oil and gas to the end users. Increased production drives investment opportunity.

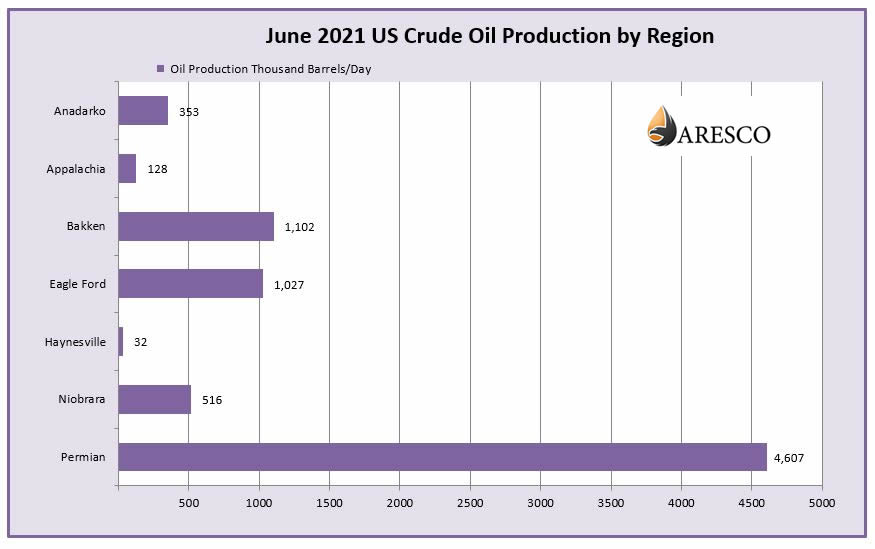

Thanks to advancements in drilling and completion technologies, oil and gas production companies are now able to tap vast domestic shale resources that previously were uneconomic. Specifically, three separate onshore fields each produced more than 1 million bbl/d in June of 2021. The Bakken shale in North Dakota surpassed 1 million bbl/d in June of 2021, reaching 1.102 million barrels per day. The Eagle Ford shale in South Texas also exceeded 1 million bbl/d in June of 2021 with 1.027 million barrels per day. The Permian basin in Texas and New Mexico topped 4 million bbl/d in June of 2021, reaching a staggering 4.607 million barrels per day. In 2021, these three fields are leading production growth in the lower 48 states, and are expected to continue to lead.

Oil & Gas Investment Strategies

Oil & Gas Investment Strategies Several investment strategies stand to benefit from this production increase. Exploration and production companies operating in the most productive basins with the best production growth should benefit as they develop their vast resource plays. Oil and gas companies with many years of well inventory and strong balance sheets are attracting capital investors as we speak and should earn attractive returns on those capital investments.

Several investment strategies stand to benefit from this production increase. Exploration and production companies operating in the most productive basins with the best production growth should benefit as they develop their vast resource plays. Oil and gas companies with many years of well inventory and strong balance sheets are attracting capital investors as we speak and should earn attractive returns on those capital investments.

Midstream oil and gas refers to the stage following extraction and primarily involves the means by which oil and natural gas is transported and stored before it reaches the refining process.

In the midstream sector, the ongoing recovery led to stronger earnings in the first quarter of 2021 and led to a flurry of mergers and acquisitions which had been slowed due to the COVID-19 pandemic. As the US and the world continue to recover from the pandemic, north American energy and its investors stand to benefit from the projected increase in energy consumption throughout the world.

Updated August 18, 2021.

© Copyright 2024 Aresco, LP. All rights reserved. | Privacy Policy | Site by A3K Marketing. Admin Log in